The envelope system requires each family member (or household) to get an envelope labeled with what they will use it for, such as “Groceries” or “Entertainment” etc., then fill it up with cash from their allowance or salary so that whenever they need something from these categories, they can just take the cash out from their envelopes without having to worry about overspending on their credit cards or dipping into savings accounts. This is great if you need some flexibility in your budget but still want to make sure that you’re saving enough each month while also putting money aside for unexpected expenses or unforeseen circumstances such as job loss. The 50/30/20 budget divides your monthly income into three categories, 50% for essentials such as bills, 30% for discretionary spending (like entertainment), and 20% for savings or debt repayment. It forces you to think about where each dollar goes instead of leaving money unaccounted for in your bank account at the end of each month. This type of budget is ideal for people who have trouble controlling their spending or if they’re trying to get out of debt. At the end of the month, all your income should be allocated and accounted for. This type of budget starts with zero dollars and requires you to allocate every dollar you earn towards something specific. Here are some of the different types of budgeting that are out there. That’s why it’s important to understand the various types of family budgets available so that you can find the one that works best for you and your family. But it can feel overwhelming knowing where to start when creating one.

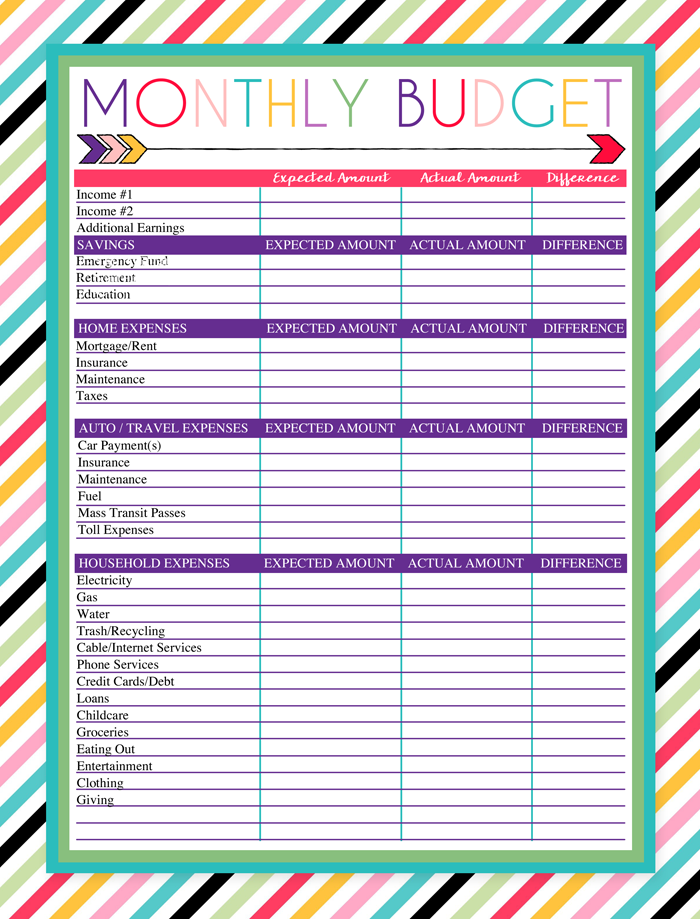

USA Household Budget Worksheet Types of Family BudgetĪs a family, having a budget can be a great way to save money and keep track of your spending.

0 kommentar(er)

0 kommentar(er)